What is Cryptocurrency? Is It Good or Bad?

Get AED 1 Million Returns*

Table of Content

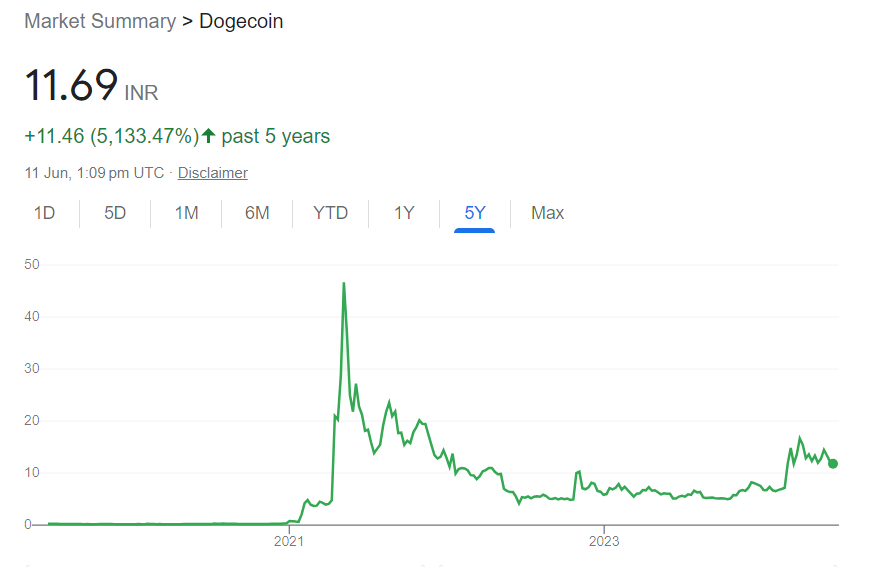

Cryptocurrency has quickly caught everyone’s attention around the world. While many have dealt with this currency to get high returns, one cannot ignore the sheer unpredictability.

Picture this: In the past 1-year, Bitcoin gave around 150% returns. Luna, on the other hand, dropped from by, well, 100% to $0*. For all the potential for growth, there could be pretty unpredictable drops as well! So if you’re considering investing in this currency, it’s important to understand it as well as the associated risks.

*As of 13 May, 2022

What is Cryptocurrency?

Cryptocurrency refers to digital or virtual currency secured through cryptographic techniques, ensuring resistance against counterfeiting and fraudulent activities. The majority of cryptocurrencies operate on decentralised networks and utilise blockchain technology — an interconnected ledger maintained by a diverse network of computers. A key characteristic of cryptocurrencies is their independence from central authorities, theoretically shielding them from governmental influence or manipulation.

How Does Crypto Fare Compared to No-Risk Investments?

Cryptocurrency is a volatile market that is still in its infancy. For all its popularity, the associated risk is quite high. Even with relatively stable options, your portfolio can be pretty much in red in no time!

All in all, cryptocurrency cannot substitute safe investments that protect your family amidst unfortunate circumstances.

Comparison with No-Risk Investments

Cryptocurrency is a volatile market that is still in its infancy. While it is certainly a popular investment instrument, it cannot substitute safe investments that protect your family amidst unfortunate circumstances.

To avoid such risk, you must consider setting aside a part of your earnings in relatively safer investment plans like ULIPS, regular savings plans, savings-cum-protection plans, and more. This will give you a great chance to grow your money without any hesitation.

How Does Cryptocurrency Work?

Before moving on to cryptocurrency trading or investment, let’s first understand how it works. In layman's terms, blockchain, within the cryptocurrency domain, functions as a digital ledger accessible to authorised users. This ledger documents transactions involving various assets, including currency, real estate, or intellectual property.

Access to this ledger is distributed among users, ensuring transparency, ease of access, and the immutability of shared information. The latter ensures that data recorded on the blockchain remains permanent and unalterable, even in the absence of administrative control.

Features of Cryptocurrency

Here are the key features of cryptocurrency compared to traditional currency systems —

- Cryptos are known for their privacy as transactions can be conducted without divulging personal information. This is usually related to a reduction in the risk of identity theft and fraudulent activities.

- Cryptocurrency investments remain secure regardless of government fluctuations, providing investors with a sense of stability.

- Although cryptos usually eliminate the need for foreign exchange calculations and bypass bank restrictions like ATM withdrawal limits, this can bring its own set of risks.

Keep in mind that legal restrictions may apply in certain countries.

Types of Cryptocurrency Used for Trading

Having understood what is cryptocurrency’s meaning, let’s understand the classification of cryptocurrency types:

- Utility tokens: These currencies fulfill specific functions within their blockchain networks. Some examples include XRP and ETH.

- Governance tokens: Representing voting or other rights on a blockchain, exemplified by tokens like Uniswap

- Transactional tokens: Notable among these is Bitcoin, the oldest cryptocurrency, which is designed primarily for use as a payment method.

- Platform tokens: Supporting applications built on a blockchain as seen with tokens like Solana.

- Security tokens: Representing ownership of assets, such as tokenised stocks. MS Token, for instance, offers partial ownership of the Millenium Sapphire.

Top Cryptocurrency Examples

Some of the well-known and trusted examples of Crypto in the market include:

- Bitcoin: Founded in 2009, Bitcoin stands as the pioneer of cryptocurrencies and remains the most widely traded. Its creation is attributed to Satoshi Nakamoto, though the true identity of this individual or group remains shrouded in mystery.

- Ethereum: Introduced in 2015, Ethereum is a blockchain platform featuring its own cryptocurrency — Ether (ETH) or Ethereum. It ranks as the second most popular cryptocurrency globally, following Bitcoin.

- Altcoins: Non-Bitcoin cryptocurrencies collectively earn the designation ‘altcoins’ to differentiate them from the original cryptocurrency. These alternatives encompass a wide range of digital currencies beyond Bitcoin.

- Litecoin: Similar to Bitcoin, Litecoin emerged with a focus on innovation, boasting faster payment processing, and increased transaction capacity. It was developed in 2011 and has since garnered attention for its swift evolution.

- Ripple: Established in 2012, Ripple operates as a distributed ledger system that is capable of tracking various transaction types beyond cryptocurrencies. Its versatility has led to collaborations with numerous banks and financial institutions.

What is Cryptomining?

Cryptocurrency or crypto mining is the process through which cryptocurrencies are created. However, it also refers to the process where transactions are verified and added to a blockchain ledger.

In this process, cryptominers utilise powerful computers to solve complex mathematical puzzles that validate and secure transactions on the blockchain network. Miners compete to solve these puzzles — the first one to solve it successfully earns the right to add a new block of transactions to the blockchain.

In return for their efforts and computational power, cryptominers are rewarded with newly created cryptocurrency coins. This process not only verifies transactions but also helps maintain the integrity and security of the decentralised blockchain network.

How to Purchase Cryptocurrency Securely?

Whether you’re looking to kickstart crypto investment or simply wish to engage in cryptocurrency trading, you need to first understand the steps to buy crypto in a safe and effective manner:

Step 1: Selecting a Platform

The first step involves choosing a platform to facilitate your cryptocurrency transactions. Two primary options include traditional brokers and specialised cryptocurrency exchanges:

Traditional brokers: Various online platforms offer a range of financial assets, including cryptocurrencies alongside stocks, bonds, and ETFs. While they typically feature lower cryptocurrency trading costs, they may offer fewer cryptocurrency options.

Cryptocurrency exchanges: Numerous exchanges offer various cryptocurrencies, wallet storage, interest-bearing accounts, and more. However, they often charge asset-based fees.

When evaluating platforms, consider factors such as available cryptocurrencies, fee structures, security measures, storage options, withdrawal methods, and educational resources.

Step 2: Funding Your Account

After selecting a platform, the next step is to fund your account to initiate trading.

Most cryptocurrency exchanges allow you to purchase cryptocurrencies using fiat currencies such as USD, GBP, or EUR via debit or credit cards, although availability may vary.

While credit card transactions are possible, they entail risks due to cryptocurrency's volatility and potential restrictions from credit card companies. Alternative payment methods may include ACH transfers and wire transfers, albeit with varying processing times and associated fees.

It's crucial to research and understand the deposit, withdrawal, and cryptocurrency trading fees associated with different payment methods and platforms.

Step 3: Placing an Order

Once your account is funded, you can place orders through the platform's web or mobile interface. To buy cryptocurrencies, select the ‘buy’ option, specify the order type, enter the desired amount of cryptocurrency, and confirm the order.

Note that the process is similar for selling cryptocurrencies.

Alternatives to Direct Crypto Investment Options

As we saw earlier, considering how cryptos can be highly volatile, we also need to look at alternative investment avenues for investing in cryptocurrencies as well as more safe ones —

- Payment services like PayPal, Cash App, and Venmo that offer the opportunity to buy, sell, and hold crypto

- Bitcoin trusts

- Bitcoin mutual funds (including Bitcoin ETFs)

- Investing in companies that specialise in blockchain technology or utilise blockchain for their operations

For more stable and safer investment instruments, you should look towards options like

- Mutual Funds

- SIPs

- Capital Guarantee Plans

- Unit Linked Insurance Plans (ULIPs)

Click here to check out the best safe investment plans right on your screen!

4 Tips for Safe Cryptocurrency Investment

While cryptocurrencies fall in the ‘risky’ category in terms of investment, you can try some things to manage the risks, especially if you’re entering the crypto industry for the first time —

- Conduct Exchange Research: Prior to investing, familiarise yourself with cryptocurrency exchanges. Over 500 options are available, which is great in terms of options but also requires thorough research, reading reviews, and seeking advice from experienced investors before proceeding with any transactions.

- Understand Storage Methods: Storing cryptocurrency is a crucial aspect of crypto investment. Whether you choose to store it on an exchange or in a digital wallet, each option comes with its own benefits, technical requirements, and security considerations. Prioritise investigating storage choices to ensure the safety of your digital assets.

- Implement Diversification: Diversifying your cryptocurrency investments is fundamental to a sound investment strategy. Rather than concentrating all funds into well-known options like Bitcoin, consider spreading investments across multiple currencies. With thousands of alternatives available, you can easily diversify your risk exposure and enhance long-term investment prospects.

- Prepare for Market Volatility: The cryptocurrency market is renowned for its high volatility, characterised by significant price fluctuations. Expect dramatic swings in prices and be mentally prepared to handle such fluctuations. If your investment portfolio or psychological well-being is sensitive to volatility, it may be prudent to reassess whether cryptocurrency investment aligns with your risk tolerance.

More From Investment

- Recents Articles

- Popular Articles

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)